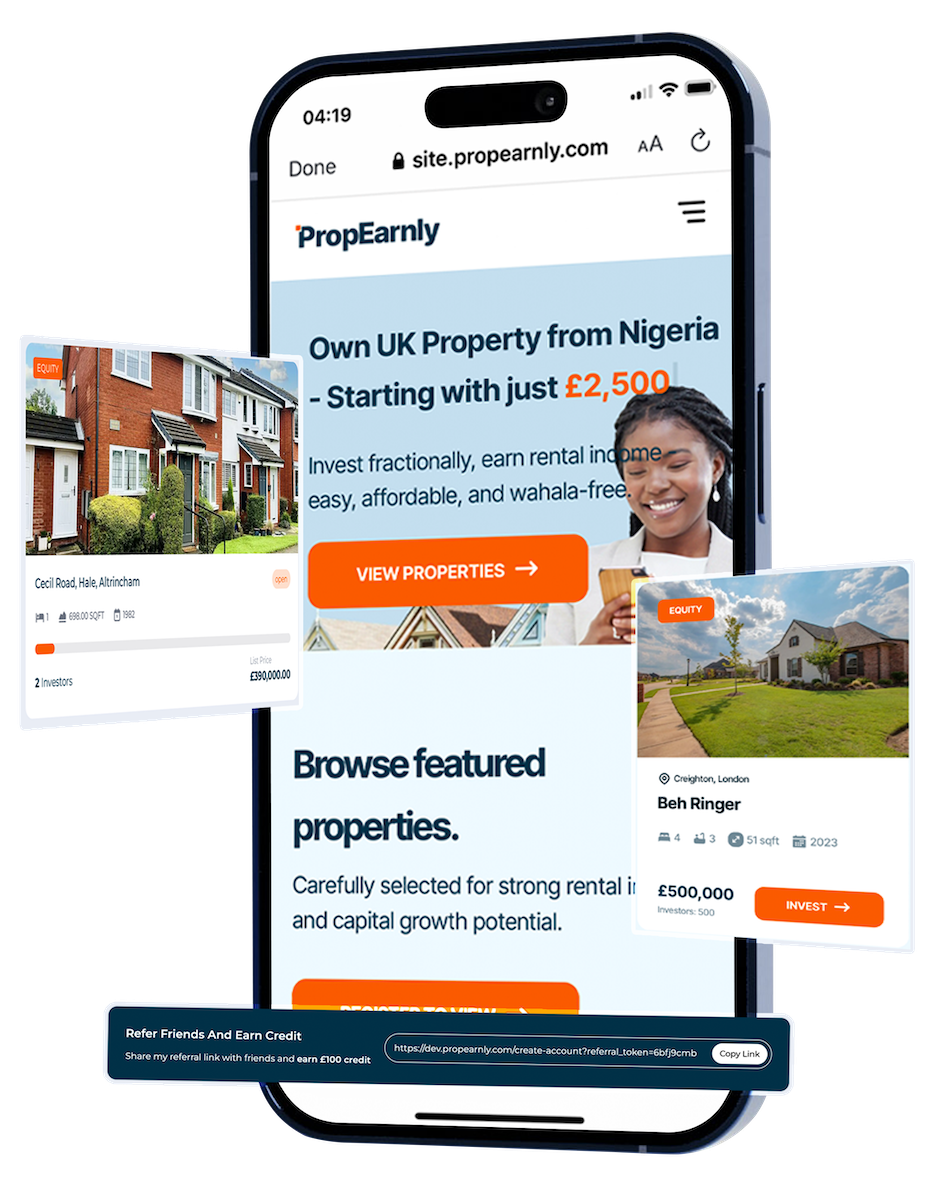

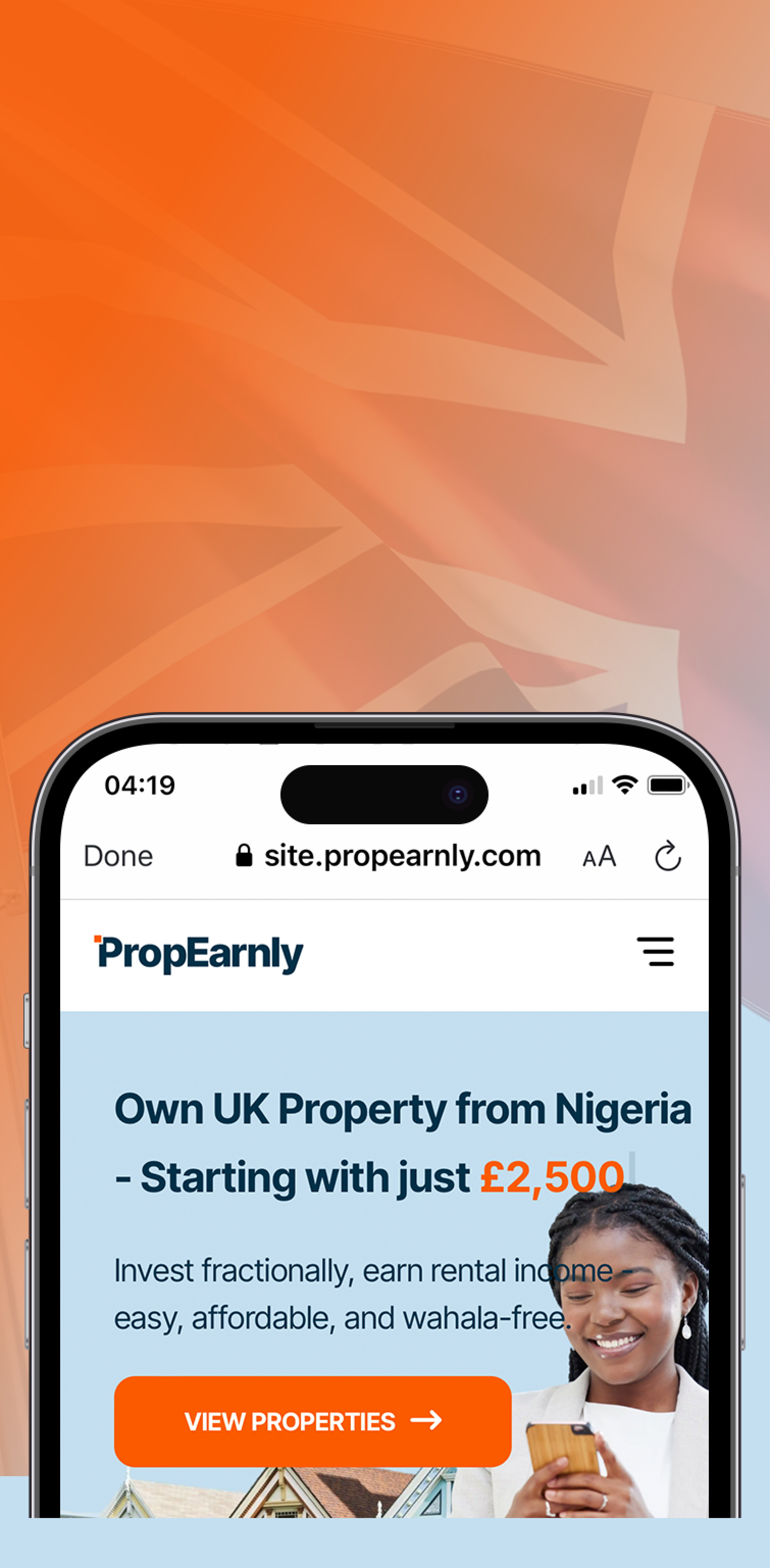

Source Prime Properties

Listed on PropEarnly

Invest from £2,500

Earn in GBP

Track and Grow

Exit Strategies (2–5 years)

The PropEarnly Advantage

At PropEarnly, we source high-quality UK properties through trusted networks and market insight. Each property undergoes rigorous vetting, and only a select few meet our strict standards for income and growth. We actively manage your investments, handling everything from tenant care to performance tracking, ensuring your portfolio is in expert hands.

UK Real Estate:

Stability with Strong Returns

UK property has delivered steady growth and reliable income for over 30 years, outperforming equities and commodities with lower volatility. With an average annual return of 10.6% over the last decade, it remains a proven hedge against inflation and economic uncertainty.

It offers a reliable hedge against inflation and economic uncertainty, with opportunities for capital growth and dependable rental income. With a strong legal system, a mature economy, and high demand for housing, the UK property market is a secure and trusted choice for investors looking to grow and protect their wealth.